Asset Turnover Ratio Standard

Equity - the Russell 3000 Value Index for periods prior to July 1 2008 and the Standard Poors 500 Index SP 500 beginning July 1 2008 and bond - the Bloomberg US. The formula for Net Asset Value can.

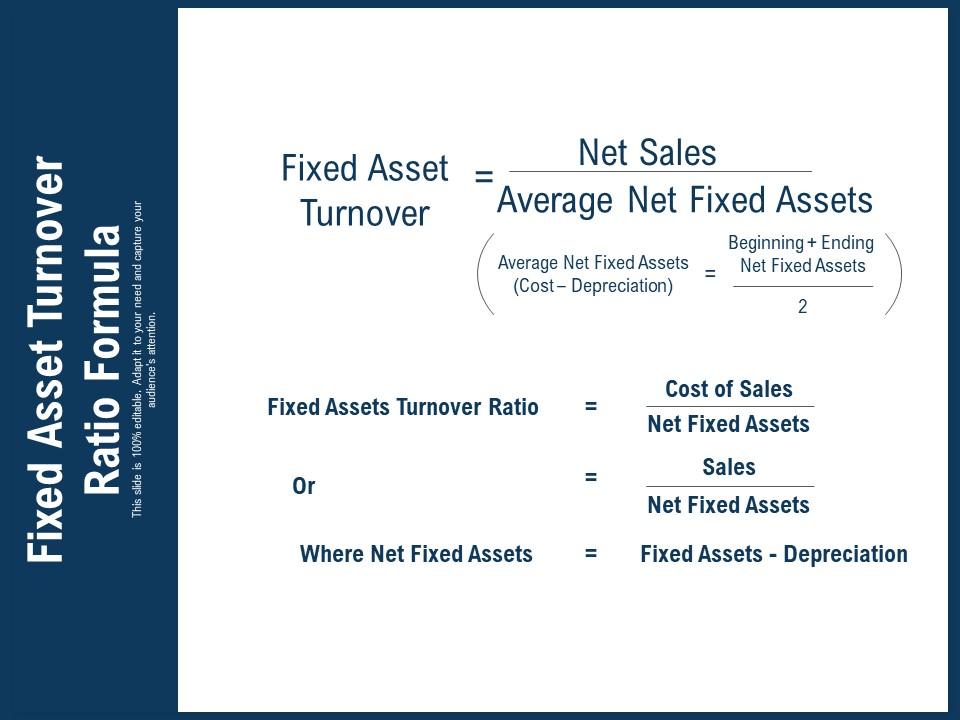

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

Explanation of Inventory Turnover Ratio Formula.

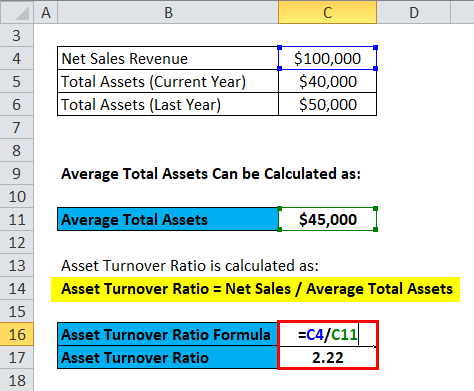

. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. The relationship between two groups or amounts that expresses how much bigger one is than the. Asset Turnover Ratio 100000 25000.

Inventory Turnover Ratio Cost of Goods Sold Avg. The profitability ratio can also be used to compare the financial performance of a similar firm ie it can be used for analysing competitor performance. Federal government websites often end in gov or mil.

Accounts payables are short term debts that a business owes to its suppliers and creditors. This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The higher the ratio the better is the companys. Borsa Italiana non ha responsabilità per il contenuto del sito a cui sta per accedere e non ha responsabilità per le informazioni contenute. To find the inventory turnover ratio.

Use of Ratio Analysis. Therefore the net asset value of UFund College Portfolio stood at 2039 per share as of June 30 2018. Economies of scale arise because of the inverse relationship between the quantity produced and per-unit.

Get 247 customer support help when you place a homework help service order with us. Some of the most used profitability ratios are return on capital employed gross profit ratio net profit ratio etc. Asset Turnover Ratio 4.

The index weightings of the composite index are rebalanced monthly. Net Asset Value 506688657 4769847 24614310. In other words measures the percentage of your investment in the fund that goes to paying management fees by comparing the mutual fund management fees with your total assets in the fund.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables. Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory.

The formula for a stock turnover ratio can be derived by using the following steps. Apple Inc Balance sheet Explanation. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment.

This indicates that for company X every dollar invested in assets generates 4. The quick ratio is an indicator of a companys short-term liquidity and measures a companys ability to meet its short-term obligations with its most liquid assets. Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods.

Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. 10 20 30 40 and 50 where the standard deviation is 10. Ratio analysis is useful in the following ways.

The following indexes are used to calculate the composite index. Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. The fund mainly invests in large- and mid-cap stocks of developed markets.

Days in Inventory 365 Inventory Turnover Ratio. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Net Asset Value 2039 per share.

Before sharing sensitive information make sure youre on a federal government site. Inventory Turnover Ratio Examples. The inventory turnover ratio can be calculated by dividing the cost of goods sold for a particular period by the average inventory for the same period of time.

Total Assets A common variation of the asset turnover ratio is. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. Updated Jun 15 2022.

Economies of scale is the cost advantage that arises with increased output of a product. Calculating Accounts Receivable Turnover. Popular Course in this category All in One Financial Analyst Bundle- 250 Courses 40 Projects 250 Online Courses 1000 Hours Verifiable Certificates Lifetime Access.

Asset Turnover Ratio is calculated as. The gov means its official. Dividend Payout Ratio Standard Deviation Compound Annual Growth Rate CAGR Discounted Cash Flow.

Days inventories outstanding 365 1044. Days inventories outstanding 3496. It has an exceptionally low turnover ratio of 31 as of December 2021 making it highly tax-efficient for investors.

Thus asset turnover ratio can be a determinant of a companys performance. Calculate the Relative Standard Deviation for the following set of numbers. The expense ratio is an efficiency ratio that calculates management expenses as a percentage of total funds invested in a mutual fund.

What is an Expense Ratio. The formula for Turnover Ratio can be calculated by using the following points. Asset Turnover Ratio Net Sales Average Total Assets.

Total assets turnover ratio of 128 times shows that net sales are above average total assets which are always favorable to have though it should be compared to previous years data as well as other players in the industry to have a complete analysis. See our resources including publications research books tools career center speakers bureau and directory of professional vendors. The standard asset turnover ratio considers all asset classes including current assets long-term assets and other assets.

Asset Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Comments

Post a Comment